tax ny gov enhanced star

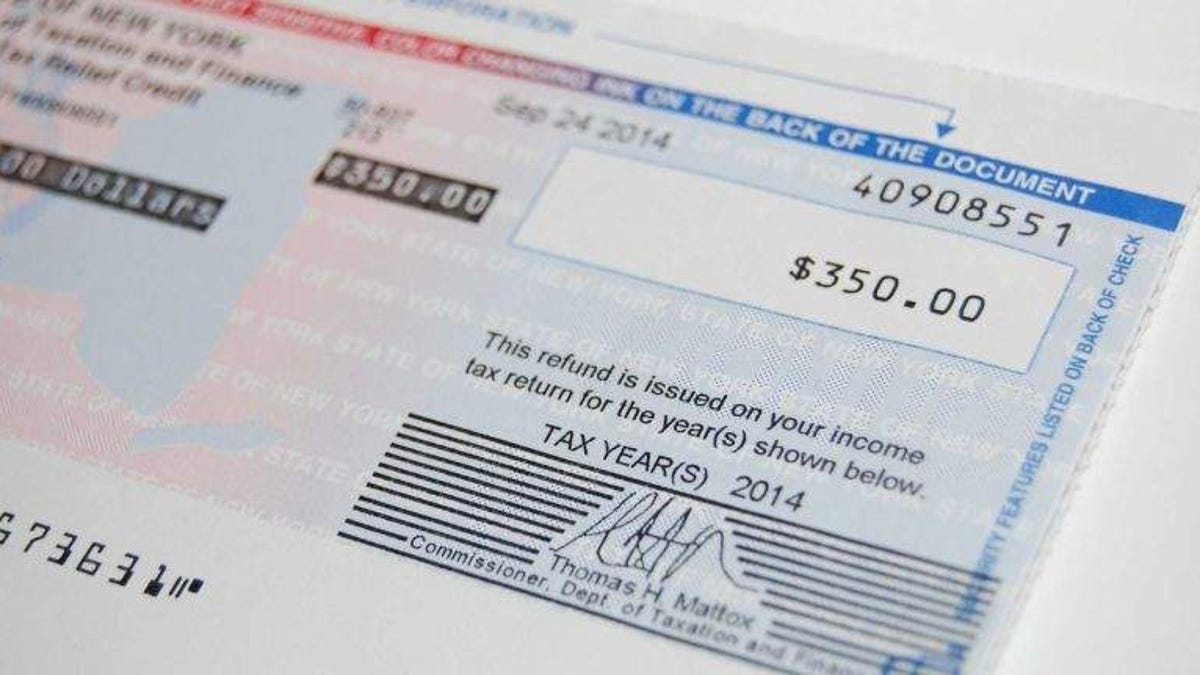

If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence. You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible.

News Flash Nassau County Ny Civicengage

Register for the Basic and Enhanced STAR credits.

. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. To be eligible for the 2022 Enhanced STAR property tax exemption seniors must. WITH THE TOWN OF BROOKHAVEN DO NOT FILE THIS FORM YOU MUST REGISTER WITH THE.

If your 2021 income was 73000 or less youre eligible to use Free File income tax software. Currently receive the Basic STAR property tax exemption. Enhanced STAR exemption applicants must submit form RP-425-E Enhanced STAR application or form RP-425-Rnw Enhanced STAR renewal application with their local assessor and show their income was no more than 86000 in the 2016 tax year you must provide a copy of your income tax return.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and. IF YOU ARE NOT CURRENTLY RECEIVING THE STAR EXEMPTION.

This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not register for the Income Verification Program IVP. For a list of who else should use this form see the instructions on page 2. For more information see Free File your income tax return.

When you apply for the Enhanced STAR exemption with your assessor along with submitting Form RP-425-IVP and Form RP-425-E you must also provide the assessor with Form RP-425-Wkst Income for STAR Purposes Worksheet. New York State revised the filing and approval procedure for all Enhanced STAR applications beginning in the 201920 tax year December 2019 to November 2020 tax bill. Enter the security code displayed below and then select Continue.

The following security code is necessary to prevent unauthorized use of this web site. If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance.

Enhanced STAR application form RP-425E. Register with the NYS Tax Department at wwwtaxnygovstar. The Basic STAR exemption is available to all eligible homeowners with incomes below 250000 regardless.

See the STAR resource center to learn more. A copy of your latest Federal or State Income Tax Return deed and drivers license must be submitted along with a complete and signed. You may be eligible for an Enhanced STAR exemption The STAR program provides eligible homeowners with relief on their school property taxes.

Star exemption information basic star exemption and star enhanced exemption beginning in 2016 any homeowner who is applying for the first time on a property meaning you have never had any star exemptions on your property before or you are a new homeowner of a property is required to register with new york state department of taxation and finance. Homeowners who received a BASIC STAR Exemption on their 202122 tax bill who will be 65 or older as of December 31 2022 only one spouse or one sibling co-owner must be 65 by this date with a household income 92000 or less in 2020 may either. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less.

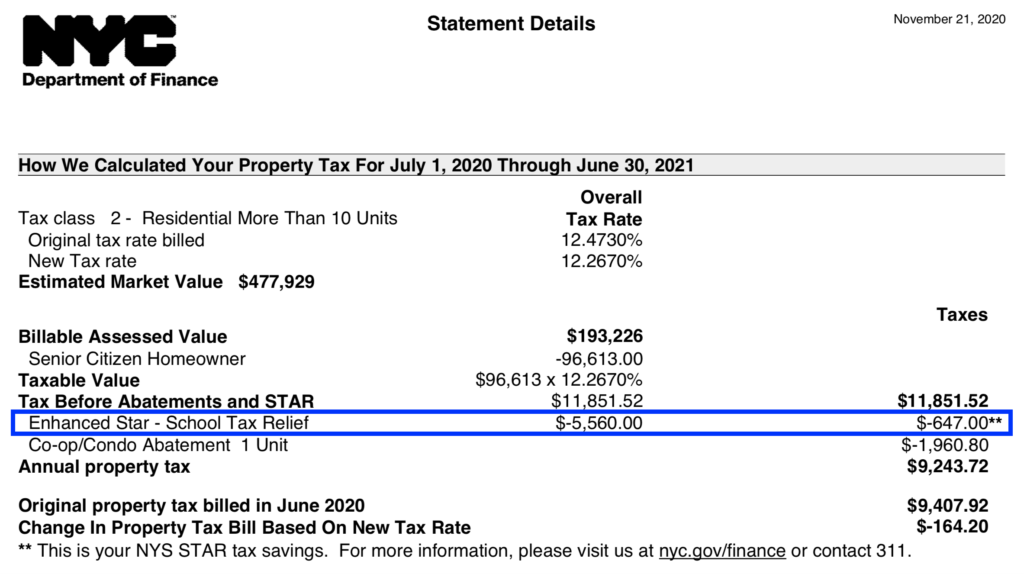

The Enhanced STAR exemption provides an increased benefit for the primary residence of a senior citizen age 65 and older who has a qualifying 2020 income of less than 92000. NEW STAR applicants must register with NYS Tax Department at 518 457-2036 or visit them at wwwtaxnygovstar. The New York State Department of Taxation and Finance is reminding seniors that for most localities the deadline to apply for greater property tax savings through the Enhanced STAR property tax exemption is March 1.

WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption. With Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. A reduction on your school tax bill.

The STAR program can save homeowners hundreds of dollars each year. The first year the assessor will use the information you provide to determine whether your income qualifies for the exemption. Enhanced Star Property Tax Senior Citizens.

Its our no-cost way to easily complete and file your federal and New York State income tax returns online. RP-425E 202 23 ENHANCED STAR APPLICATION. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET.

There are two types of STAR exemptions. The Tax Department will automatically upgrade them to Enhanced STAR if they qualify. RP-425-MBE 122 wwwtaxnygov Property key.

If you are using a screen reading program select listen to have the number announced. Prepare and file your income tax return with Free File. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out.

Senator Kathy Marchione reminds constituents turning 65 in 2017 of fast approaching March 1 deadline to apply for Enhanced STAR benefit and reduce their property taxes. Seniors who receive the STAR credit instead of the STAR exemption dont need to apply or take any other action. Seniors with questions about the STAR exemption can contact the Tax Departments STAR Hotline from 830 am.

As long as you. The New York State Department of Taxation and Finance will annually determine income eligibility for qualifying Enhanced STAR applicants. Were processing your request.

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Assessor Town Of Chester Orange County New York

Governor Cuomo Signs Fy 2022 Budget And Announces Continuation Of Middle Class Tax Cuts To Help New Yorkers Recover From Economic Hardship During The Covid 19 Pandemic Governor Kathy Hochul

Governor Cuomo Signs Fy 2022 Budget And Announces Continuation Of Middle Class Tax Cuts To Help New Yorkers Recover From Economic Hardship During The Covid 19 Pandemic Governor Kathy Hochul

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

New Two Star Property Tax Relief Bill By Tedisco Lawler Seeks End To New York S Tax Eternity Ny State Senate

Here S What Hochul S Tax Relief Plan Means For New Yorkers Silive Com

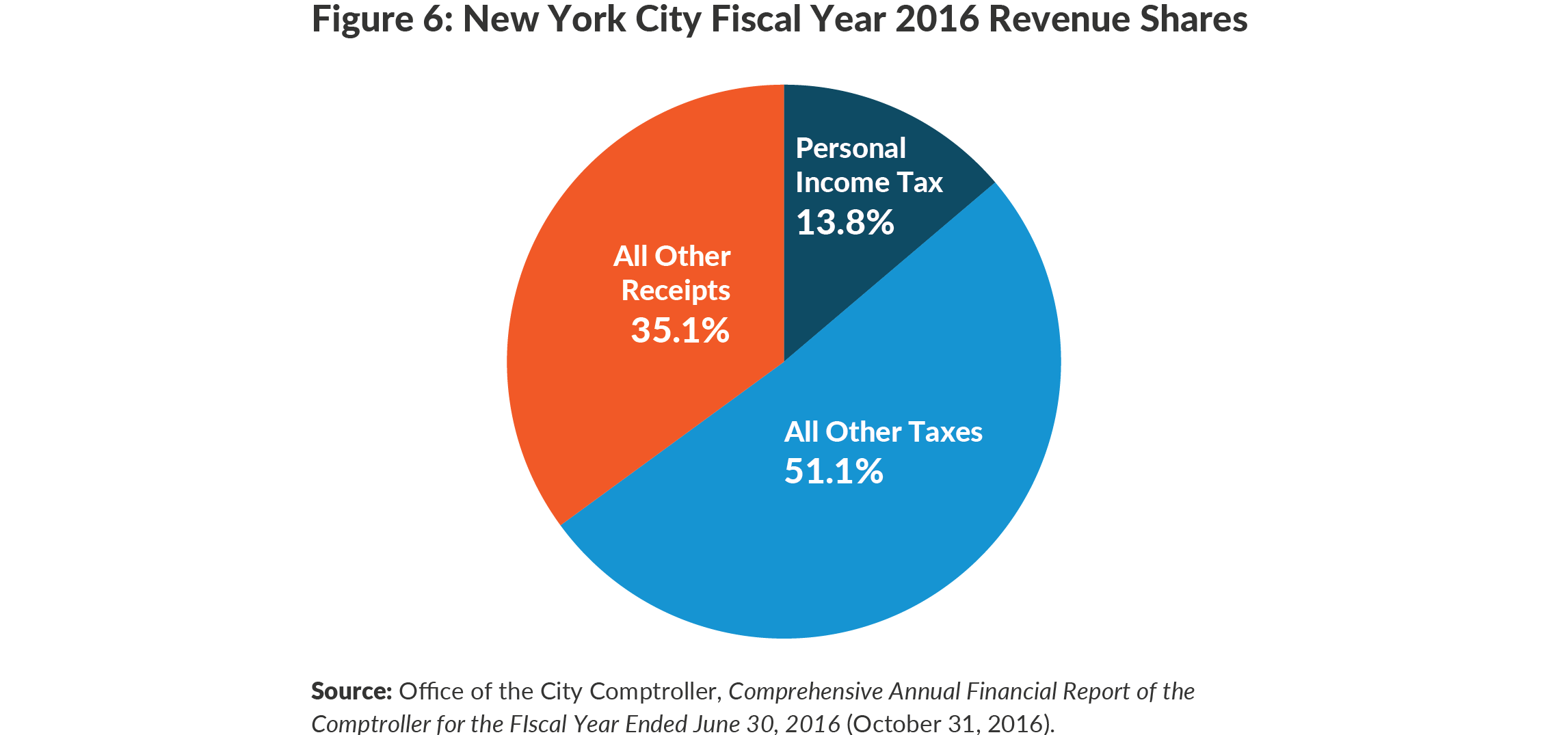

Personal Income Tax Revenues In New York State And City Cbcny

The School Tax Relief Star Program Faq Ny State Senate

Village Tax Information Ossining Ny

Receiver Of Taxes Town Of Oyster Bay

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit